Kiera and I hang’n out at Point Pelee, the southernmost tip of mainland Canada. (Middle Island is actually the Southernmost point in Canada.)

The point I’m trying to make (yes, there actually is one!) is exactly what I wrote last year, i.e., personal resources (time and money) directed towards experiences as against “stuff” are the keys to both short and long term happiness. This is one of the reasons we feel so good when we are engaged in acts of giving through its many different levels – not just money, but also time, friendship and, most important … love.

DEC 24, 2025

Memory Lane

BY KEITH THOMSON

For the last 12 years it has been my tradition to close out the year by featuring an advert which I feel best captures the spirit of the holidays. Fortunately my 20 year-old daughter, Kiera, loves Christmas commercials and we have spent many happy hours together filtering through dozens of candidates to find Kiera and Keith’s “Holiday Commercial of the Year Award”.

Our completely unscientific and hugely biased winner of our 2025 "Holiday Commercial of the Year Award” goes to Chevrolet’s Memory Lane. At just over three minutes, this ad beautifully reminds us of the impact of shared memories … especially during the holiday season. We also agreed that the video was so much better for its inclusion of the background song “To Build a Home” with vocals and piano performed by Canadian singer-songwriter Patrick Watson.

As 2025 winds down, my team at CI Private Wealth and I hope you have the opportunity to spend more time with family and friends and, during those quieter times, have a chance to reflect on the people and moments that bring significance to your lives.

Merry Christmas and a very happy New Year!

The greatest journey is the one we take together.

–Anonymous

NOV 12, 2025

Gold - The Ultimate Belief Asset

BY KEITH THOMSON

Gold is the ultimate “belief asset” and frankly … I’m a non-believer. Having said that, I have been 100% wrong on gold based on the recent price movement of the shiny metal. Perhaps I should explain what I mean by the term “belief asset”.

Gold provides no income stream, no dividends, and no rent. Quite simply, it’s an asset that is absolutely impossible to value by any conventional financial metric. Its value simply trades on what other people think it’s worth*. The more cynical amongst us would call this “the greater fool theory”. Although there is no doubt that I have been the fool over these last couple of years.

The main challenge I have with “belief assets” (such as gold and crypto) is that their price movements are always and forever at the whim of investor’s emotions which, at times, like right now (with gold trading at around $4,000 U.S./ounce) has been extremely lucrative for many individuals. However, most of the time (and sometimes over years and decades) it's absolutely financially gut wrenching. As Ben Carlson writes in his excellent blog Why I Don’t Own Any Gold, “I just don’t have the stomach for an asset that has the ability to experience three lost decades out of four”.

Admittedly, the chart shown above is an excellent example of data mining as it ends in 2023 before gold’s most recent epic run-up. However, in my defence, if I extended the chart to November 2025, a $100 in gold in 1970 would be worth approximately $11,120 today. What about $100 invested in the S&P 500 in 1970? Today it would be worth just over $32,000. (Source: StatMuse)

One of my financial mentors once wrote that not having financial FOMO (fear of missing out) is critical to your success as a long-term investor. In other words, if one owns a truly diversified portfolio, you must accept the fact that from time to time you will have no choice but to watch people own assets (often the same people you may feel are less informed and/or intelligent than yourself😊) who make a lot more money than you! At least … temporarily.

Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again, and pay people to stand around guarding it.

OCT 16, 2025

Living With The Investment Elephant Next Door

BY KEITH THOMSON

Why invest outside Canada and specifically, why the U.S.?

The simple answer is … if you have a truly diversified portfolio you should be allocating your portfolio by asset class (i.e. equities, fixed income, real estate, etc.) … and by country. And the one country you can’t ignore is the U.S.

As illustrated in the graphic below, the U.S. market is absolutely massive, accounting for almost half of the entire global stock market capitalization! Closer to home, with eight times the population of Canada, the U.S. market is approximately 18 times the size of Canada.

Historically, the U.S. share of the global stock market has fluctuated dramatically. At the start of the 1970’s it was approximately 70% then declined in the 80’s due to the Japanese stock market bubble. Within the last 15 years the U.S. market capitalization, as a percentage of the world’s, has increased from 30% to 49%.

Suffice it to say, you may not like the current president of the U.S.A. or his administration. You may not like their current policies and attitude towards Canada, but do not let your feelings influence your behaviour when it comes to your investment portfolio.

The trouble with Canada is that we exist in the almighty shadow of the United States. It’s like living next door to a family of alcoholics - we wave and smile nicely and hope they don’t come over.

–Anonymous

SEP 26, 2025

Winter is Coming Redux

BY KEITH THOMSON

You know we’ve had a great run in the markets when, in the same week, two of my clients (I assume half kidding) said to me, “I’m making too much money!” All joking aside, it has indeed been a great time to be invested with even the more conservative portfolios I manage registering double digit annualized growth over the last three years. It is why I thought it would be helpful to resend my thoughts from last November (with a few updates) … when we were also coming off of another great year of returns.

Despite the title of this month’s Wealth with Wisdom, I consider myself a rational optimist. Admittedly, at least when it comes to this year’s incredible returns, my attitude is a relatively easy one to hold. However, winter is indeed coming.

Many individuals have a tendency to forget that about every four to six years, the markets decline temporarily (on average), by around 30%. Even more challenging, once or twice a generation there is a decline of around 50%. I’m sure you can recall the Great Financial Crisis of ‘08 to ‘09 which took the S&P 500 index down 57%.

Perhaps surprisingly, as reflected by this chart (as of June 30th, 2025) … every … single … year … as indicated by the red dots, the market has a tendency, on average, to decline around 14%. And as you can see, in April of this year, we had the Trump tariff induced decline of 19%.

These somewhat sobering statistics can be countered by one irrefutable fact. If you are a long-term investor your decision to sell over the last 100 years has been a bad one. Having said that, in the future there is little doubt we will continue to experience gut wrenching (albeit temporary) stock market declines. However, if you accept this rather unpleasant reality, and even more importantly, plan for it … you will be just fine.

As nice as it would be to know when to trade in and out of the market in anticipation of market declines and advances, unfortunately the economy can not be forecast nor the markets timed. And although we are completely powerless to predict when and how stocks will stop declining, it is far more important to keep in mind that they actually will stop dropping at some point in the future.

As Morgan Housel, my favourite financial writer/commentator once stated, “Expecting things to be bad is the best way to be pleasantly surprised when they are not”. From my perspective, being short term paranoid (i.e. winter is coming) but long term optimistic, is a very profitable mind set for most investors.

Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in the corrections themselves.

AUG 28, 2025

Rich Dad Poor Dad. Mostly Poor Dad

BY KEITH THOMSON

Back in the late 90s I had the opportunity to read Robert Kiyosaki’s best seller, Rich Dad Poor Dad. At that time I found it an excellent resource to help me appreciate the mindset differences between “rich” and “poor”. Not surprisingly, Mr. Kiyosaki went on to create a veritable cottage industry of follow-up books, spin-offs, seminars, and collaborations exploiting the success of his first book. Not only that, he also decided to get into the stock market forecasting racket becoming, what I would call, a “wannabe Nostradamus“.

For Exhibit A, I invite you to read the following link, Warren Buffett and Michael Burry are ready and waiting for a stock market crash, ‘Rich Dad Poor Dad’ author says. Please note that the article was published on August 16, 2023 when the Dow Jones Industrial Average closed at 35,094. As I write this, a little over two years later, it trades at 45,631 … or 30% higher than when Mr. Kiyosaki was predicting an imminent crash based on what he thought were the actions of two famous investors.

Here’s the thing, I’m not trying to pick specifically on Robert Kiyosaki. However, the point I’m attempting to make is, those individuals that delude themselves into believing they have some sort of investing crystal ball, tend to eat a lot of broken glass. Every year I have clients who reference some famous pundit who is predicting financial Armageddon. This was especially true last fall when Trump won the US election. Please understand, I'm not suggesting we will never experience a market decline at some point in the future. In fact, I absolutely guarantee that we will! I just don’t know when it’s going to happen, its depth, or duration. And here’s the thing … no one else does either.

In the end I’m not paid for predicting when it will rain. I’m paid for building your family's financial ark.

We’ve long felt that the only value of stock forecasters

is to make fortunetellers look good.

JUL 23, 2025

Mid-Year Report

BY KEITH THOMSON

It is my pleasure to report to you on the progress of your portfolio during the rather tumultuous first six months of this very eventful year.

As always, let's first remember a handful of the timeless truths about enduringly successful wealth management—principles that guide our work together toward your goals. Then we can proceed to some more current observations.

General principles

-

We are goal-focused, plan-driven, long-term equity investors. Our portfolios are derived from and driven by your most important lifetime financial goals, not any view of the economy or the markets.

-

We don't believe the economy can be consistently forecast, or the markets consistently timed. Nor do we believe it is possible to gain any advantage by going in and out of the equity market, regardless of current conditions.

-

We therefore believe that the most efficient method of capturing the full premium compound return of equities is by remaining fully invested all the time.

-

We are thus prepared to ride out the equity market's frequent, often significant but historically always temporary declines. We believe that even during such trying episodes, our reinvested dividends will be buying more lower-priced shares—and that the power of equity compounding will be continuing, to our long-term benefit.

Current commentary

-

If you looked at the equity market on the first trading day of this year, and not again until the end of June, you could be forgiven for concluding that not much—if anything—had happened. In fact, a great deal happened—but at least so far, to no lasting effect.

-

The S&P 500 Index made a new all-time high on February 19th. By April 8th, it had closed 18.9% lower. And even that doesn't express the degree of sheer panic—there's no other word for it—that enveloped the markets upon President Trump's announcement (on April 2nd) of a dramatically increased tariff protocol.

-

The panic ended just as abruptly after Mr. Trump announced a 90-day postponement of most of the new tariffs. And since then—buoyed by continued strength in the North American economy and signs that inflation may be continuing to moderate—the indexes (both Canadian and U.S.) not only returned to the neighbourhood of their early January levels, but more recently have made record highs.

-

As it virtually always is, the optimal course of action for long-term investors was simply to continue to stay the course in regard to your portfolio and continue to work your financial plan. (On this point I very much appreciate I tend to sound like a broken record!) And as the second half of the year begins, that recommendation stands. Please don't mistake this for an economic or market outlook (see above quote). I have no such forecast for the next six months, any more than I did on January 1st.

-

My only forecast is that many excellent businesses of the kind we own will go on innovating over time—increasing their earnings, raising their dividends, and supporting my clients' pursuit of their long-term goals.

-

Panic doesn't often seize the investing public as suddenly as it did in the first week of April, nor vanish as suddenly as it did the following week. Still, this episode can and should serve as a kind of tutorial.

-

st quality equities at panic prices. I believe that's always the fundamental choice in investing, and my professional mission in life, is to help you continue to choose wisely.Its lesson: investors succeed over time by continuously working their plan regardless of the current “crisis du jour.” Others fail by reacting to negative events and liquidating even the highe

As always … I welcome your comments and questions. Thank you for working with me. It is a privilege to serve you.

I don’t get paid for predicting when it will rain … I get paid for building financial arks.

–Anonymous

JUN 23, 2025

How I Earn My Fee

BY KEITH THOMSON

How do I earn my fee? Hint - It’s probably not what you think.

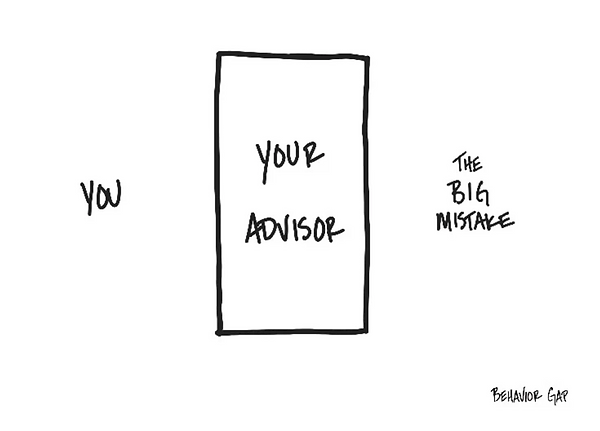

Suggesting to potential clients that my main value to them is to make sure they and their family never implode financially is, quite frankly, somewhat of a hard sell. One of my financial industry mentors, Nick Murray, calls this … making sure the clients I work with do not make The Big Mistake. To that end, if I could boil it down to a simple equation, earning my fee would look something like this:

-

Helping the families I work with identify their financial goals and develop a Financial Plan to achieve those goals with a diversified portfolio heavily weighted towards equities.

…80%

-

Always being there for my clients while continually working their Financial Plan through all the cycles of the economy, and all the fears and fads of the market. …20%

-

Analyzing/interpreting the economy and current events.

…0%

-

Timing the market, and calling tops and bottoms.

…0%

-

Identifying consistently top performing investments.

…0%

Total…100%

In the end, I find that behavioural finance is a lot more behaviour than finance.

If you think it’s expensive to hire a professional to do the job, wait until you hire an amateur.

MAY 23, 2025

Fees vs. Fines

BY KEITH THOMSON

It has been my experience that engineers are often bad investors. Why? Because their mindset, quite rightly, focuses on the need for absolute certainty. As an example, the bridge that they design has to have a 100% chance of withstanding any load that crosses it, not 50%, not 80% … but 100%. The stock market is the opposite of designing bridges.

The markets are all about uncertainty. I can state that the stock market (based on reams of evidence), over the long term, has an excellent chance of making you a lot of money. However, unlike the engineer who lets drivers know they can drive their cars across the bridge with no concern regarding their safety … I can not absolutelyguarantee that you will make a lot of money in the stock market.

A good example of the volatility of markets can be exemplified by how the S&P 500 has reacted since Trump won the election last November. At first, it increased rapidly. Then, this past April, it declined almost 19% reflecting concerns over the implementation of tariffs. And now, as I write this, it is essentially flat on a year-to-date basis. Understandably, this kind of volatility drives most people nuts! But here’s the thing, volatility is a fee not a fine. Volatility in the stock markets is not like a speeding ticket where you are penalized for doing something wrong. It is more like a fee, such as a cost of a ticket to a concert, which you have to pay to gain access to something good.

I can show you that over the decades the North American stock markets have an annualized return of close to 10%. However, to come anywhere close to enjoying those returns, you would have had to put up with the recent decline of 19%, the 25% decline in ‘22, the 33.9% decline during Covid, the 56.8% decline in ‘08/‘09, or the 49.1% decline in ‘00/‘02. (Source: A Wealth of Common Sense)

Investing in the world’s stock markets is a “package deal”. In order to experience the superior returns a well diversified portfolio has historically provided … you must be able to pay the fee of volatility.

P.S. For more on this topic, I encourage you to listen to this excellent 12-minute podcast from Morgan Housel.

Be more patient in investing is the sleep eight hours of health. It sounds too simple to take seriously but will probably make a bigger difference than anything else you do.

APR 16, 2025

The Package

BY KEITH THOMSON

That was definitely not fun … watching the markets decline precipitously in a matter of days. Even worse … watching the effect it had on our individual investment portfolios.

At its worst (as I write this), the S&P 500 had fallen, temporarily, almost 20%. The catalyst being President Trump's obsession with tariffs which, if fully enacted, will unwind a decades long trend towards more free and open markets around the world. Unfortunately, I have to assume that the President missed this classic scene from the 1980’s movie, Ferris Bueller’s Day Off, which pretty much explains everything you need to know about tariffs.

Here’s the thing, temporary declines like the one we have just experienced are incredibly common. Here's one of my favourite charts highlighting the fact that the market, on average, declines 14.1% … every … single … year. (And more than double that decline every 3-5 years.) This is what I refer to as “the package”.

What is “the package”? Specifically, it is the understanding that for putting up with these admittedly stomach churning temporary declines, you are rewarded with the superior long-term returns that a basket of highly profitable companies from around the world will provide for you.

You wouldn’t be human if you didn't react negatively to these frequent, but temporary, market declines, but if you want to enjoy the long term returns “the package” provides… please don’t act on those emotions.

P.S. For an excellent Morningstar article by Jeffrey Ptak, please read “You Know Nothing - Embrace That and You’ll Earn a Decent Return”.

Your success as an investor will be determined by how you respond to punctuated moments of terror, not the years spent on cruise control.

MAR 26, 2025

The Trick Is Not Minding That It Hurts

BY KEITH THOMSON

Last May I returned from the Berkshire Hathaway Annual Shareholders' Meeting. This was my second visit, counting myself extremely fortunate the year before to have seen, for the last time, both Warren Buffet and Charlie Munger on stage together. Unfortunately, Munger passed away in late ‘23 at the age of 99. I will always remember Charlie’s wit and wisdom. Frankly, much of his investment and life philosophy have informed the direction of my own life. I was again reminded of this fact after re-reading the quotation above. I posted a version of this blog last year but, given the recent “Trump induced market turbulance”, I thought it might be a good idea to re-visit the topic of volatility when it comes to each of our own portfolios.

Since 2000 we have experienced two market declines of approximately 50%. But here’s the thing … absolutely critical to your success as a long term equity investor is your ability to ride out these painful, but unavoidable (and unpredictable) temporary market declines. In the classic 1962 movie Lawrence of Arabia there is a scene that reminds me of this fact. Based on the life of T. E. Lawrence, played by Peter O’Toole, there is a line where he states, "The trick, William Potter, is not minding that it hurts".

And so it is with volatility. We all love volatility on the upside, but volatility on the downside … not-so-much. Never forget that the key to making money in the stock market is not being scared out of it.

Referencing the chart below, the average temporary decline since 1950 in the U.S. stock market has been approximately -14% … every … single … year. Interesting that so far this year, at its worst, the market has declined “only” -10.1%.

I get it, temporary declines hurt emotionally. You wouldn’t be human if they did not. However, the trick to satisfactory investment outcomes is attempting not to mind that it hurts.

P.S. For a further intelligent read on market volatility I encourage you to to click through to Ben Carlson’s excellent short article, Volatility Clusters.

If you can’t stomach 50% declines in your investment, you will get the mediocre returns you deserve.

FEB 20, 2025

What Went Right in 2024?

BY KEITH THOMSON

What went right in 2024?

Well, for one thing at least, 60 countries went to the polls including India (the largest democracy in the world) and the U.S. (the world’s oldest continuous democracy). To quote the Wall Street Journal, “In a fractious year, democracies operated smoothly and peacefully under pressure, while rising economies, falling crime, and advances in medical care bode well for the future”. You could be forgiven for not knowing this as the media (in all its forms) overwhelmingly amplifies the negative. One may not like this fact, but it is understandable, thanks to humanity’s evolution, which prioritizes threats over all other considerations, and negative headlines receive more attention — surely one reason why floundering news outlets are producing more and more of them!

Edwards Deming once wrote, “In God we trust, all others bring data”. To that end I bring you 86 Stories of Progress from 2024.

I absolutely believe that rational optimism, as it relates to our imperfect world, is the more realistic viewpoint. In fact, I would argue that it is extremely difficult to be a successful long term investor without actually being a rational optimist. Admittedly, however, maintaining such a perspective is a constant uphill struggle. As we begin the new year, I hope these 86 stories will help make it a bit easier for you.

Have a great 2025!

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair.

JAN 7, 2025

What We Believe - 2025 Edition

BY KEITH THOMSON

Long time readers of this newsletter may recall that it is my habit at the beginning of each year to summarize my thoughts regarding the markets and economy from the past year. But perhaps more importantly, to reiterate my philosophy as it pertains to the management of my clients' wealth. I'm happy to report on another very successful year in our shared pursuit of your most cherished lifetime financial goals. Our plan and our portfolio continue to be driven by those goals, rather than by prognostication around the economy or the markets. This will continue to be the case in 2025 and beyond.

I begin by restating some of our core beliefs, and proceed to a few comments about the current economic/financial backdrop.

General Principles:

-

We are long-term, goal-focused, plan-driven investors. Our core investment policy is to invest in broadly diversified portfolios of high quality businesses.

-

We believe that the economy can't be consistently forecast, nor the markets consistently timed. We conclude from this that the only practical way to capture the premium long-term return of equities is to ride out their frequent, sometimes significant, but historically always temporary, declines.

-

We do not react to economic or market events. As long as your long-term goals remain unchanged, so will our plan for the achievement of those goals.

Current Commentary:

-

Powered largely by very few of the largest technology stocks, the past year was another exceptionally good one for the diversified equity investor. As the year came to a close, the market gave evidence of broadening out to some extent. That would certainly be welcome.

-

The U.S. election result was at least clear and uncontested. The economic backdrop continued favourable. The job market remained fairly strong. Corporate earnings and dividends reached record highs and are forecast to increase further in 2025.

-

If anything, late in the year many investors feared that the equity market got ahead of itself, as evidenced by somewhat stretched valuations. Since valuations have never proven to be a reliable timing tool—any more than anything else has—we encouraged clients to just keep on keeping on with their plan.

-

Inflation (especially in the States) has not gone away. Nor, as the U.S. Fed Chair Powell observed in mid-December, is it going away anytime soon. A frothy market took this statement rather badly, as indeed, in my opinion, it should have.

-

It doesn't seem reasonable to suppose that the broad equity market (as reflected by the S&P 500) can go on indefinitely compounding at the nearly 16% it's been producing since the March 2009 Global Financial Crisis lows. Nor do we need it to. Our long-term plans assume hundred-year diversified equity returns at around ten percent keeping in mind that since 1928 the S&P 500 has been in a bull market on nearly 80% of all trading days (Source: Bespoke Investment Group).

-

The near-term outlook for the market is arguably favourable but one should always keep one's stock market seat belts fastened.

I wish all our clients and friends a healthy, happy and prosperous 2025! We're always here to answer your questions or address your concerns. Thank you for being our clients. It is a privilege to serve you.

People have always had this craving to have someone tell them the future. Long ago, kings would hire people to read sheep guts. There’s always been a market for people who pretend to know the future. Listening to today’s forecasters is just as crazy as when the king hired the guy to look at the sheep guts.

DEC 10, 2024

Midnight Opus

BY KEITH THOMSON

For the last 11 years it has been my tradition to close out the year by featuring an advert which I feel best captures the spirit of the holidays. Fortunately my 19 year-old daughter, Kiera, loves Christmas commercials and we have spent many happy hours together filtering through dozens of candidates to find our “Holiday Commercial of the Year Award”.

We managed, with great difficulty, to whittle down the competition to just three finalists. Coming in at number three was a holiday ad from the Austrian financial services provider, Erste, called Silent Night. It tells the true story behind the beloved carol of the same name. A bit of Christmas trivia - Silent Night is the most recorded song in history, with over 130,000 versions in 300 languages.

Apple released a winner entitled Heartstrings - a story about a father who is shown to be experiencing hearing loss. The fact that the company is peddling AirPods Pro is outweighed by a commercial that features themes of disability and accessibility within its poignant, but not overly sentimental narrative.

And finally, my completely unscientific and hugely biased winner of our 2024 "Holiday Commercial of the Year Award” goes to … drum roll please … Amazon’s Midnight Opus. This 90-second ad shares how small, thoughtful acts of kindness may act as catalysts to bring people together. I’m a huge fan of Burt Bacharach and Hal David so I was happy that they used their 1965 classic What The World Needs Now Is Love. I’m not so sure, but Kiera is convinced that Richard Goodall, this year’s winner of America’s Got Talent, was the inspiration for the commercial. 😊

As 2024 winds down I hope you have the opportunity to spend more time with family and friends and, during those quieter times, have a chance to reflect on the people and moments that bring significance to your lives.

Merry Christmas and a very happy New Year!

What the world needs now is love, sweet love. It’s the only thing that there’s just too little of.

NOV 21, 2024

Winter is Coming

BY KEITH THOMSON

Despite the title of this month’s Wealth with Wisdom, I consider myself a rational optimist. Admittedly, at least when it comes to this year’s incredible returns, my attitude is a relatively easy one to hold. However, winter is indeed coming.

Many individuals have a tendency to forget about every four to six years that the markets decline temporarily (on average), by around 30%. Even more challenging, once or twice a generation there is a decline of around 50%. I’m sure you can recall the Great Financial Crisis of ‘08 to ‘09 which took the S&P 500 index down 57%.

Perhaps surprisingly, as reflected by the chart below, … every … single … year … as indicated by the red dots, the market has a tendency, on average, to decline around 14%.

These somewhat sobering statistics can be countered by one irrefutable fact. If you are a long-term investor your decision to sell over the last 100 years has been a bad one. Having said that, in the future there is little doubt we will continue to experience gut wrenching (albeit temporary) stock market declines. However, if you accept this rather unpleasant reality, and even more importantly ... plan for it … you will be okay.

As nice as it would be to know when to trade in and out of the market in anticipation of market declines and advances, unfortunately the economy can not be forecast nor the markets timed. And although we are completely powerless to predict when and how stocks will stop declining, it is far more important to keep in mind that they actually will stop dropping at some point in the future.

As Morgan Housel, my favourite writer/commentator once stated, “Expecting things to be bad is the best way to be pleasantly surprised when they are not”. From my perspective, being short term paranoid but long term optimistic is an effective strategy for most investors.

Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in the corrections themselves.

OCT 11, 2024

Would You Trade Places With Warren Buffet?

BY KEITH THOMSON

Would you rather have $0 and be 30 years old or have a $141 billion and be 94? (Buffet’s net worth and age.) I can’t think of anyone who wouldn't choose the former, but the interesting reality is that many individuals seem to optimize for the latter. (If not $141 billion then at least a very large number.)

As this excellent article points out, life is often about resource trade-offs. Specifically, time, money, and health. On a related subject the most common regrets by individuals nearing death according to the book, The Five Regrets of Dying, are:

1) “I wish I’d had the courage to live a life true to myself, not the life others expected.”

2) “I wish I hadn’t worked so hard.”

3) "I wish I’d had the courage to express my feelings."

4) “I wish I had stayed in touch with my friends.”

5) "I wish that I had let myself be happier."

What I find fascinating from the above list is that none involve money, yet many of us tend to optimize our lives for the largest net worth number at the end of it! As illustrated in the graph below, this results in what could be referred to as the “regret gap”. Specifically, when we are younger, and have our health, we have a tendency to put off spending money on experiences till we are older and presumably wealthier. Unfortunately, many of these experiences are no longer available to us as we age (i.e travel). This is the regret gap.

Perhaps we should learn to aim to solve for net fulfillment versus net worth.

As Owen Stoneking sums up, “In this new example, sure our wealth builds more slowly (because we exchanged the opportunity to earn more money for additional free time and better health), but a lot of the things we want to do early-on in life require health and time, not money. The things that require money and time (more so than health) should be saved for the latter years”.

Admittedly, this is a lot easier said than done … I’ve had a net worth “number” in my head for most of my life and it still pains me to take dollars out of my portfolio to spend money on experiences that, ironically, I know I will love and cherish (memory dividends) for the rest of my life.

Again, quoting from Stoneking, “We were all put on this earth to do more than just accumulate money. Money is a crucial component of maximizing fulfillment, but we should be aware of the trade offs and reflect on what we truly want to do with it. Experiences make us rich”.

In the end, I feel the regrets we have in life do not revolve around what we did … but what we did not do.

A healthy person has a thousand wishes, a sick person has only one.

–Indian proverb

SEP 25, 2024

The Most Dangerous Person In Your Investing World

BY KEITH THOMSON

I believe Morgan Housel’s “Covid crash” quotation thoughtfully distills approximately 80% of an investor’s long term success in the stock market. We’ve all heard of Maslow’s Hierarchy of Needs but are you familiar with The Hierarchy of Investor Needs? If you truly appreciate what Morgan Housel is articulating in the below article, you’ll probably be able to successfully navigate future challenging markets.

The Hierarchy of Investor Needs

By: Morgan Housel, One Step at a Time, The Motley Fool

One summer in college I interned at an investment bank. It was the worst job I ever had. A co-worker and I survived our days by bonding over a mutual interest in the stock market.

My co-worker was brilliant. Scary brilliant. The kind of guy you feel bad hanging out with because he makes you realize how dumb you are. He could dissect a company’s balance sheet and analyze business strategies like no one else I knew or have known since. He was the smartest investor I ever met.

He went to an Ivy League school, and after college he landed a high-paying gig at an investment firm. He went on to produce some of the worst investment results you can imagine, with an uncanny ability to pile into whatever asset was about to lose half its value.

This guy is a genius on paper. But he didn’t have the disposition to be a successful investor. He had a gambling mentality and couldn’t grasp that his book intelligence didn’t translate into investing intelligence, which made him wildly overconfident. His textbook investing brilliance didn’t matter. His emotional faults led him to be a terrible investor.

He’s a great example of a powerful investing truth: You can be brilliant on one hand but still fail miserably because of what you lack on the other.

There is a hierarchy of investor needs, in other words. Some investing skills have to be mastered before any other skills matter at all.

Here’s a pyramid I made to show what I mean. The most important investing topic is at the bottom. Each topic has to be mastered before the one above it matters:

Every one of these topics is incredibly important. None should be belittled.

But you can be the best stock-picker in the world, yet if you buy high and sell low – the epitome of bad investing behavior – none of it will matter. You will fail as an investor.

You can be a great stock-picker, but if you only have 20% of your assets in stocks – a poor asset allocation for most investors – you’re not going to move the needle.

You can be a super-tax-efficient investor. But if your stock selection is poor, you’re not going to have many capital gains to pay taxes on in the first place. And if you’re paying too much for advice, tax savings can be irrelevant.

A common problem for any investor to stumble on is the temptation to solve one problem without first mastering a more fundamental one. It can drive you crazy, because if you’ve gotten the hang of an advanced topic, you might think that you’re on the road to success, but something more basic like investor behavior or asset allocation could still put you on a road to ruin. Just like my old co-worker.

Copyright 1995-2022 The Motley Fool. All rights reserved. — A version of this blog appeared in June, 2022

Keith again ... I find that many people spend far too much time focusing on the top of the investment pyramid. Probably (but not only) because this is what financial journalism focuses on as it emphasizes what is quantifiable, scary, and urgent. Clearly understanding that it’s your potential poor behaviour which makes you possibly the most dangerous person in your investing world, is key to your long term success as an equity investor.

How you behaved in March 2020 was probably more important than what you did in the previous 100 months combined.

AUG 16, 2024

The Politics of Investing

BY KEITH THOMSON

About every four years I receive enquiries from clients regarding how the U.S. presidential election will affect the stock market. Translation … how negatively will the markets react to either a Trump/Vance or Harris/Walz win? Or, more specifically, how much could my portfolio decline? Unfortunately, the truthful answer is - nobody knows or can ever actually know - is not very satisfying emotionally. This is especially so with the upcoming U.S. election cycle where we seem to be living (again) through the politics of total confusion.

Under the title of “a picture is worth a thousand words”, I share with you the following chart:

Click to enlarge

Any logical, long-term investor should conclude three things:

-

It doesn’t much matter who is elected to the White House.

-

The market goes up over the long term.

-

The best course of action, in any election year is just to stay invested.

In conclusion, I leave you with the immortal words of Charlie Munger, “The first rule of compounding is to never interrupt it unnecessarily”.

JUL 24, 2024

Should a 19 Year-Old Have a Will?

BY KEITH THOMSON

Earlier this year my daughter, Kiera, turned 19 and just recently I encouraged her to create a Will. Actually, I insisted she do this … which, more than likely from her perspective, is a downside of living with a financial advisor as a father. The catalyst for this “suggestion” was Tanja and I deciding that we needed to update our own estate plans. Frankly, there wasn’t much to change except that we felt our daughter was responsible enough to inherit a percentage of our estate at an earlier age. As you may know, dying without a Will in Ontario means you’re considered to have died intestate. This situation takes the decision making power away from you and your loved ones and into the hands of the state. In the case of an intestate death Ontario Succession Law Reform Act steps in and dictates how the estate is distributed.

Which brings us back to Kiera’s estate plans. Over the last couple of years we have contributed to her Tax Free Savings Account (TFSA) and First Home Savings Account (FHSA), the result being that she now owns a not insignificant portfolio, the distribution of which we would most definitely not wish the state to be involved in. As my friend, Sarah Morkin, wrote in her excellent blog, online platforms now offer a great solution for relatively straightforward estate plans.

We used the company Willful but there are also a number of other solid on-line platforms (Epilogue, CanadaWills). In Willful’s case a basic plan can be created with an investment for as little as $99.

Kiera creating her first Will in less than five minutes for $189.

The bottom line is … for large or complicated estates I would always recommend the services of an excellent lawyer who specializes in estate planning. However, for all other Canadians (even 19 year-olds) I would very much consider and recommend the option of utilizing easy to use, simple, and inexpensive on-line estate planning platforms.

I am always relieved when someone is delivering a eulogy and I realize that I’m listening to it.

JUN 26, 2024

Confessions of a Financial Advisor

BY KEITH THOMSON

If you know me reasonably well, you would probably agree that one of my worst personality traits is my extreme impatience. The single positive of this trait is that I tend to get stuff done. The negative is … well … pretty much everything else. This “everything else” has historically overlapped into my personal investing history.

Between the years 2006 and 2012 I lost an embarrassing amount of money owing to my concern that I was not getting wealthy fast enough. I take a degree of comfort in knowing that the family capital I put at risk during those years was not so relevant that I was completely taken “out of the game”. Having said that, the reasons I lost all that money are so completely cliché that I’m hesitant to share them … but here goes:

- Too much money invested in start-ups. In retrospect, I chose to ignore the stats that approximately 80% of new businesses go to zero.

- Trusting the opinions of individuals whom I thought to have the answers.

- Related to the above point, placing too much faith in senior management.

- Not realizing how fast technology can eviscerate a business model.

- Becoming too emotionally involved in a business.

- Partnering with an individual who had mental health challenges. (I could write a book on this one!)

- Believing in the infallibility of my own analyses.

- Enjoying a financial windfall giving me far too much liquidity for my own good.

I can rhyme off the above quickly because I started to keep a journal of my investment “experiences“ in the hope that I would never repeat the same mistake twice. As an aside, unfortunately I have never been very good at adopting Charlie Munger's philosophy that, “It’s good to learn from your mistakes. It’s better to learn from other people's mistakes.” The good news is that I have indeed learned from my mistakes, given that over the last 12 years my investment returns have been more than satisfactory, with no self-imposed financial blow ups. The better news, at least for my clients during those years between ’06 and ‘12, is that I took a, “Do as I say, not as I do” investment philosophy.

Which brings me to the point of this month’s newsletter. Actually ... two points.

As the Carl Richards graphic so wonderfully illustrates, diversification (as boring as it may be) actually works. Specifically, in turn for never making a killing … you will never get killed!

The second point, as highlighted in the quote at the top of this blog, is that average returns over very long periods of time can lead to truly outstanding financial outcomes. Having worked with a number of clients over two to three decades I have come to appreciate, owing to the incredible power of compounding, one does not have to get rich quickly. In fact, at age 62 my personal investing mantra is now completely focused on how to get wealthy slowly through quiet compounding.

For more on this topic I invite you to read Ben Carlson’s excellent article, “Not Getting Rich Fast Enough”.

Average performance sustained for an above-average period of time leads to extraordinary performance. This is true not just in investing but careers, relationships, and parenting.

MAY 17, 2024

The Trick is Not Minding That it Hurts

BY KEITH THOMSON

Earlier this month I returned from the Berkshire Hathaway Annual Shareholders' Meeting. This was my second visit, counting myself extremely fortunate in May, 2023 to have seen for the last time both Warren Buffet and Charlie Munger on stage together. It felt as though the “shadow” of Charlie permeated this year’s proceedings, given he passed away this recent November at the age of 99. I will always remember Charlie’s wit and wisdom. Frankly, much of his investment and life philosophy has informed the direction of my own life. I was again reminded of this fact after re-reading the quotation above.

Since 2000 we have experienced two market declines of approximately 50%. But here’s the thing … absolutely critical to your success as a long term equity investor is your ability to ride out these painful, but unavoidable (and unpredictable) temporary market declines. In the classic 1962 movie Lawrence of Arabia there is a scene that reminds me of this fact. Based on the life of T. E. Lawrence, played by Peter O’Toole, there is a line where he states, “The trick, William Potter, is not minding that it hurts”.

And so it is with volatility. We all love volatility on the upside but volatility on the downside … not-so-much. And, at the risk of sounding like a broken record, the key to making money in the stock market is not being scared out of it. One of my favourite investment charts is from J.P. Morgan. It highlights the fact that since 1980 on average, as reflected by the red percentage numbers, the market declines temporarily 14.2% every single year.

I get it ... temporary declines hurt emotionally (you wouldn’t be human if they did not). However, the trick to satisfactory investment outcomes is attempting not to mind that it hurts.

If you can’t stomach 50% declines in your investment, you will get the mediocre returns you deserve.

MAY 12, 2024

Find Me a Specialist

BY KEITH THOMSON

Finding the right partner to work with to achieve your philanthropic goals isn’t easy, but choosing wisely can make all the difference.

“This is one of the most important areas of my life and I don’t know who to hire. Frankly, I don’t even know what I should be looking for. Can you help me?” lamented Mr. Smith (name has been changed), a well-known and successful Toronto business owner. He asked me this question after one of my presentations illustrating that by redirecting the taxes on their estate which, otherwise, would be paid to the Canada Revenue Agency, Canadians could leave more to family, friends and those causes most meaningful to them.

As you might imagine, Mr. Smith isn’t the first to ask me that question. Perhaps you’ve been asking the very same question. Ideally, given the inherent complexities of organizing your estate effectively, your first step should most certainly be to work with specialists.

Specialists focus on you, work with people like you, and are acknowledged “All-Stars”.

A Specialist Focuses on You and Your Needs

The best way to determine someone’s focus is to spend some time with that person. “I barely had time to speak,” complained Anna, a single, retired woman, who took the time to interview prospective advisors to determine whether or not they were specialists. That’s a real tipoff: true specialists don’t do most of the talking when you first meet.

When they do speak, are they helping you think about your dreams and concerns or are they talking about what they do? That’s the second tipoff – the main job of a true specialists is to assist in determining what’s most important and most urgent to you.

A Specialist Helps People Just Like You

Thirdly, do you understand them? Do they speak in plain language or in industry jargon?

Additionally, you need to ask your advisor a few questions: What’s their professional specialty? Do they have a description of their ideal client? How much have they saved their clients in taxes through their planning?

A Specialist is an Acknowledged All-Star

Lastly, make sure your specialist is an All-Star. Every profession knows its All-Stars and there’s even a big difference even between a major leaguer and an All-Star. All-Stars should have proven performance. Have they published in their field? Do they also teach their professional peers?

Warren Buffet said his advisors must be people he can trust implicitly, people who are at the top of their game professionally and with whom he enjoys spending time. To me, that’s another way to say “specialists” – individuals who focus on you, work exclusively with people just like you and who are All-Stars.

SAVE THE DATE!

On May 22, internationally recognized financial educator Keith Thomson will give a special presentation on how to lower your income tax and even eliminate your estate tax. We hope you can join us!

APR 19, 2024

Why You Are Rich

BY KEITH THOMSON

If you are reading this there is a very good chance you are wealthier than 90% of the Canadian population. Have you ever paused to think why this may be the case? Of course there could be any number of reasons that quickly come to mind such as living below your means and saving the difference, the long term compounding of returns in your portfolio or owning high quality companies etc. However Morgan Housel, a partner at Collaborative Fund and one of the most astute financial writers blogging today, has some ideas on the subject which you probably have not thought of.

One, you are wealthy because you are a pleasant sociopath. As Housel writes, “I’m convinced that nearly every rich person has the characteristics of a sociopath. Not in a cruel, soulless way. But sociopaths can discharge emotional events that cause normal people to worry and panic. Great investors can do that, too. They can watch stocks fall 50% and shrug their shoulders or see 10 million people lose their jobs and remain unshakably calm.” Napolean’s definition of a military genius was ‘The man who can do the average thing when all those around him are going crazy’. Perhaps you are wealthy because you are the same – you can remain normal when all those around you are losing their heads.”

Two, you are wealthy because you do things differently. Again Morgan Housel writes, “The funniest thing about rich people is how little their income has to do with their wealth. Mike Tyson earned $300 million during his career and went broke. An orphaned, unmarried administrative assistant died with millions in the bank.”

Three, you care about time periods most can’t comprehend. Think about it this way, there are four ways to invest:

-

Unsuccessfully

-

Long term (varying degrees of success)

-

Short term (successful due to luck)

-

Short term (successful due to manipulation/fraud)

Reflecting on the above options one comes to the inevitable conclusion that the only logical way to invest is over the long term. But here’s the thing … it’s totally unnatural! As human beings it has been encoded into our DNA to go for the immediate gains and avoid imminent threats.

Carl Richards, the artist of the above sketch, notes that we have the same emotional connection to ourselves 30 years in the future as we do to a complete stranger. The bottom line is that nearly all sizeable accumulations of wealth can be traced to a single variable, a long term outlook.

Four, you are wealthy because you don’t give a damn what other people think of you! Finally, Morgan Housel points out, “The price of being rich is really simple: You must live below your means. But living below your means is hard. Most people want to be rich to impress other people. They do this by spending money, which is the surest way to have less of it. Rich people avoid this trap. A lot of them are after control over their time, which comes from having a wide gap between what they can afford to buy and what they actually buy.” Or, as the poet William Shenstone once wrote, “A miser grows rich by seeming poor. An extravagant man grows poor by seeming rich”.

P.S. A version of this newsletter was published in July 2017.

Like all of life’s rich emotional experiences, the full flavor of losing important money cannot be conveyed by literature. You cannot convey to an inexperienced girl what it is truly like to be a wife and mother. There are certain things that cannot be adequately explained to a virgin by words and pictures.

(Author of “Where Are the Customers’ Yachts?” First published in 1940)

MAR 26, 2024

Time To Feed The Goose!

BY KEITH THOMSON

Please find below two CI Private Wealth tax resources which may assist you in dealing with your tax reporting.

CIPW 2024 Personal Tax Calendar (link to PDF)

This gives you a list of important dates for personal tax filing and planning for this year.

CIPW 2023 Personal Tax Organizer (link to PDF)

This provides you with a checklist to help you compile the information you need to complete your personal income tax returns, whether you do it yourself or engage the services of a Professional Tax Preparer.

As we prepare for this year’s “plucking” perhaps this article will help minimize the “hissing”. Written by Ryan Holiday, it is directed towards an American audience (with a Stoic bent). However, if you change the date to April 30th, the message is no different for us Canadians.

The Taxes of Life

Daily Stoic - Ryan Holiday

"April 17th is the day that Americans pay their taxes. It’s a day of mixed reactions depending on your outlook and politics. Some choose to focus on the good things their taxes pay for and have paid for since Roman times—the roads, the armies, services for the poor. Others focus on the waste (tax corruption and waste is also as old as Rome) or question the morality of the system altogether. Last year when we posted a note about taxes, a number of comments wrote angrily that “taxation is theft!” while others angrily responded to those commenters with defenses of their own. (All this anger being somewhat ironic for Stoics.)

In a way, this misses the point. What we should be doing is zooming out and looking at the larger picture: People have been complaining about their taxes since the beginning of civilization. And what has become of it? Taxes are higher than ever and they’re dead. Death and taxes. There is no escape. So let us waste no time and create no misery kicking and screaming about it. Let us not add to our tax bracket the cost of frustration and resentment.

Taxes are an inevitable part of life. There is a cost to everything we do. As Seneca wrote to Lucilius, “All the things which cause complaint or dread are like the taxes of life—things from which, my dear Lucilius, you should never hope for exemption or seek escape.” Income taxes are not the only taxes you pay in life. They are just the financial form. Everything we do has a toll attached to it. Waiting around is a tax on traveling. Rumors and gossip are the taxes that come from acquiring a public persona. Disagreements and occasional frustration are taxes placed on even the happiest of relationships. Theft is a tax on abundance and having things that other people want. Stress and problems are tariffs that come attached to success. And on and on and on.

There’s no reason or time to be angry about any of this. Instead, we should be grateful. Because taxes—literal or figurative—are impossible without wealth. So what are you going to focus on? That you owe something, or that you are lucky enough to own something that can be taxed."

Taxes are our way of feeding the goose that lays the golden eggs of freedom, democracy and enterprise. Someone says, 'Well, the goose eats too much!’. That’s probably true. But better a fat goose than no goose at all.

FEB 13, 2024

It Was The Best of Times, It Was The Worst of Times - 2024 Edition

BY KEITH THOMSON

Early each year it has been my tradition to share with my readers how our world is making tremendous progress on just about any metric you care to focus on. Unfortunately though, it seems many of us still believe that our planet is quite literally going to hell in a hand basket! This perspective is understandable given the 24/7 continual bombardment from news reports, articles, podcasts, and social media channels.

Edwards Deming once wrote, “In God we trust, all others bring data”. To that end, I bring you 66 Good News Stories You Didn’t Hear About in 2023.

Perhaps I can offer this summary … just because the world is far from perfect, this doesn’t mean things are not getting better. With this thought in mind, I wish you, your family, and friends an ever improving 2024!

It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of light, it was the season of darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to heaven, we were all going direct the other way.

JAN 24, 2024

What We Believe - 2024 Edition

BY KEITH THOMSON

It is both simple and genuinely compelling for me to be able to summarize the behaviour of North American equity markets, not only for the last calendar year but over the last two years. In fact, I can do so in two sentences.

In 2022, the Dow, the S&P 500 and the Nasdaq 100 (the largest most diversified stock markets in the world) experienced peak-to-trough declines of 21%, 25% and 35% respectively. A week before Christmas 2023, all three were in new high ground on a total return basis (i.e., including dividends).

Why stocks did this is quite irrelevant compared to the wonderful lessons that can be drawn from this experience. There are almost as many theories and explanations as to why this happened as there are market commentators, of whom I am happily not one. I would point out, however, that the number of said commentators who successfully forecast both the market action of 2022 and that of 2023 is, to my knowledge, rounds to zero.

What should really matter for all of us long-term, goal-focused, plan-driven equity investors is not why this happened, but that it happened. Specifically, that there could be a pervasive and very significant bear market over most of one year, and that those same declines could be entirely erased in the following year. Although in the largest sense not nearly as quick or as perfectly symmetrical as the 2022-23 experience, that is how it works.

So, as always, I will break my year-end letter into two parts: first, the timeless and enduring principles reinforced by these two years, and then a consideration of current conditions.

General Principles

-

The economy cannot be consistently forecast, nor the market consistently timed. Thus we believe that the highest probability method of capturing equities' long-term return is simply to remain invested all the time.

-

We are long-term owners of businesses as opposed to speculators on the near-term trend of stock prices.

-

Declines in the mainstream equity market, though frequent and sometimes quite significant, have always been surmounted as the word’s most consistently successful companies ceaselessly innovate.

-

Long-term investment success most reliably depends on making a plan and acting continuously on that plan.

-

An investment policy based on anticipating (or reacting to) current economic, financial or political events/trends most often fails in the long run.

Current Commentary

-

I remain convinced that the long-term disruptions and distortions resulting from the COVID pandemic are still working themselves out in the economy, the markets and society itself, in ways that cannot be predicted, much less rendered into coherent investment policy.

-

The primary financial event in response to COVID was an explosion in the money supply by central banks around the world. It predictably ignited a firestorm of inflation.

-

To stamp out that inflation, these same central banks implemented the sharpest, fastest interest rate spike in history. Both debt and equity markets cratered in response.

-

Despite this, economic activity just about everywhere has remained relatively robust; employment activity has been largely unaffected, at least so far.

-

Inflation has come down significantly. But prices for most goods and nearly all services remain elevated, straining middle-class budgets.

-

Capital markets around the world have recovered significantly as speculation now centers on when and how much lower interest rates may come to pass in 2024.

-

Significant uncertainties abound. Trends in both the Canadian and U.S deficits and national debts continue to appear unsustainable. In the U.S., unless reformed, Social Security and Medicare appear to be on paths leading to eventual insolvency. And, as we all know, a bitterly partisan U.S. presidential election looms later this year. The markets will face significant challenges in the year just beginning—as indeed they do every year.

My overall recommendations to you are essentially what they were two years ago at this time, and what they've always been. Let's revisit your most important long-term financial goals soon. If we find that those goals haven't changed, I'll recommend staying with our current plan. And if our plan isn't changing, there most probably will be no reason to alter your portfolio materially.

As always, I welcome your questions and comments, I look forward to talking with you soon, and thank you again for the opportunity to work with you. It's a privilege for me to do so.

Recessions and bear markets are very easy to predict, except for the timing, cause, magnitude, duration, location, and policy response.

By providing your email address, you provide us with your express consent to send you commercial electronic messages related to finances and/or investments that maybe of interest to you. Should you wish to discontinue receiving emails of this nature, you may contact us to withdraw your consent at any time. Your personal information will not be distributed, sold, or traded – it will remain strictly confidential and will only be used for the purpose for which it was provided. For more information on CI Private Wealth’s commitment to privacy and responsible use of information, please click here.